The eOption brokerage company has been specializing in options trading since 2007 and today promises to provide its clients with a wide range of investment instruments. The pricing system in it is aimed at active players operating in international markets.

The parent company of the broker is Regal Securities, Inc, one of the members of the Investor Protection Corporation, which is based in the United States. We will tell you about other details regarding this broker in this review.

Company age

According to Who Is, the eoption.com domain name has existed since June 1997, which means the company is 25 years old.

The main activity of the broker is trading in stocks, bonds and options. In addition, it offers tools for optimizing and analyzing trading strategies like OptionsPlay.

The issue of regulation

The footer of the company’s website indicates that it has licenses from two respected financial regulators at once: FINRA and SIPC. These data are confirmed by checking the relevant registries.

This means that the broker works absolutely legally, and you can trust him.

Terms of trade

The following accounts exist for eOption clients:

- for American users – a deposit of 500 dollars;

- for international accounts – a deposit of 25 thousand dollars.

A prerequisite is the transfer of funds to the account within a month from the date of its opening. Otherwise, it will be impossible to use it.

Options are the main vector of work of eoption.com. Other investment instruments are also presented: ETFs, securities, mutual funds and bonds.

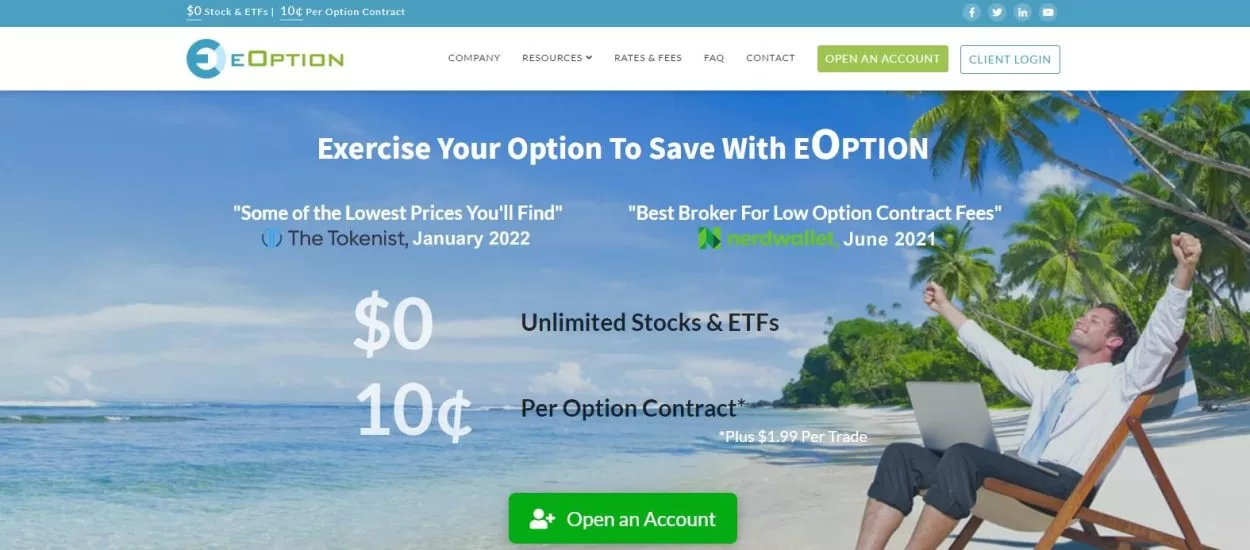

Commissions

The eOption broker sets a low level of commissions for investors. So, for stocks and ETFs, they are $0, but in the case of placement with a broker, they are $6.

The options will cost the player $0.10 per contract. It is worth adding another $ 2 to automatic trading with this type of asset.

Foreign stock fees are $39.

IRA accounts are charged $15 annually in commissions, and regular accounts are charged $50 annually.

Support

You can contact the broker’s support via e-mail, mobile number or chat, which is presented on the site. Judging by the feedback from traders, the answer comes pretty quickly.

Platform

The broker offers its clients to use the ETNA trading platform or its own eOption Trader. In addition, there is also a mobile platform in which auto trading is available. Other developments are available for an additional fee.

The main trading takes place in the browser. It has all the features for fundamental analysis, charting and research. Broker clients can customize the interface themselves. In use, this development is quite simple.

Company reputation

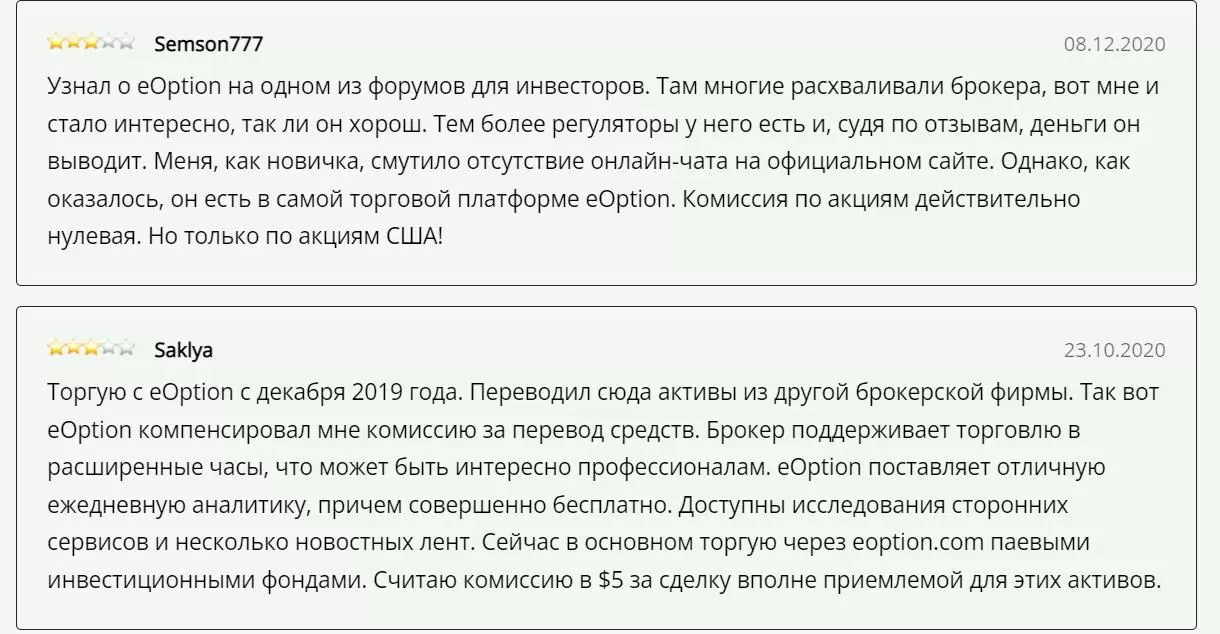

Reviews about the eOption broker are very different. So, some praise him, while others find something to criticize for.

Whether to contact eoption.com is up to you. We advise you to approach it as responsibly as possible!