Choosing a reliable broker is an extremely important stage of trading. It is a key step in building a successful earning strategy. In this matter, it is important to focus on the legal framework of the office, tariff range, functionality of trading platforms and reviews of traders already working with the financial assistant. Now we will take a closer look at AMarkets and find out how this figure works in the market.

History and regulation

The international online broker has been running its project for more than 15 years, having founded the company in 2007. At the moment, the representative has dozens of offices in Europe, Asia, Latin America, the Middle East, Africa and the CIS countries.

Initially, the intermediary was called AForex. Its head office is located in the Cook Islands. The company is licensed by the Hong Kong Financial Commission and the Trading Services Authority in Saint Vincent and the Grenadines, and is also authorized to provide traders with access to exchanges in many countries around the world on its own basis.

In addition, the broker is a member of the independent regulatory agency TFC, one of whose services is insurance of company members for up to 20 thousand euros per trade claim. In addition, the office is subject to a monthly audit by VerifyMyTrade and Ernst&Young, the results of which are publicly available.

The representative’s funds are stored in the accounts of liquidity providers and prime brokers, and hedging of client positions is carried out on them. Such partners are the British X Open Hub, which, with the permission of the FCA, has books in European banks and makes it possible to execute transactions in the STP system.

Website and trading platforms

The broker’s main page is quite simply and concisely designed, but in some ways this is a drawback. For example, it is difficult to find regulatory documents or other useful information about the representative from the very beginning. The platform mainly talks about processes related directly to trading.

AMarkets provides access to the most popular trading platforms that have long earned the recognition of users:

- MetaTrader 4 is a multifunctional database with a set of extensive tools: analysis of market quotes using technical indicators and chart figures, opening purchase and sale transactions simultaneously, creating and using an algorithmic trading system, hedging positions, etc.;

- MetaTrader 5 is an improved version of the previous platform. It has faster and more convenient functionality, a modernized programming language and an economic calendar;

- WebTrader is an online platform of the MetaTrader4 terminal, the system of which is completely understandable and identical. It is accessible from any computer with a full possible service set after logging into the account;

- Mobile applications MT4 and MT5 (iOS and Android) are simplified telephone versions of the above platforms. There is an undeniable convenience in working in markets anywhere that is equipped with an Internet connection.

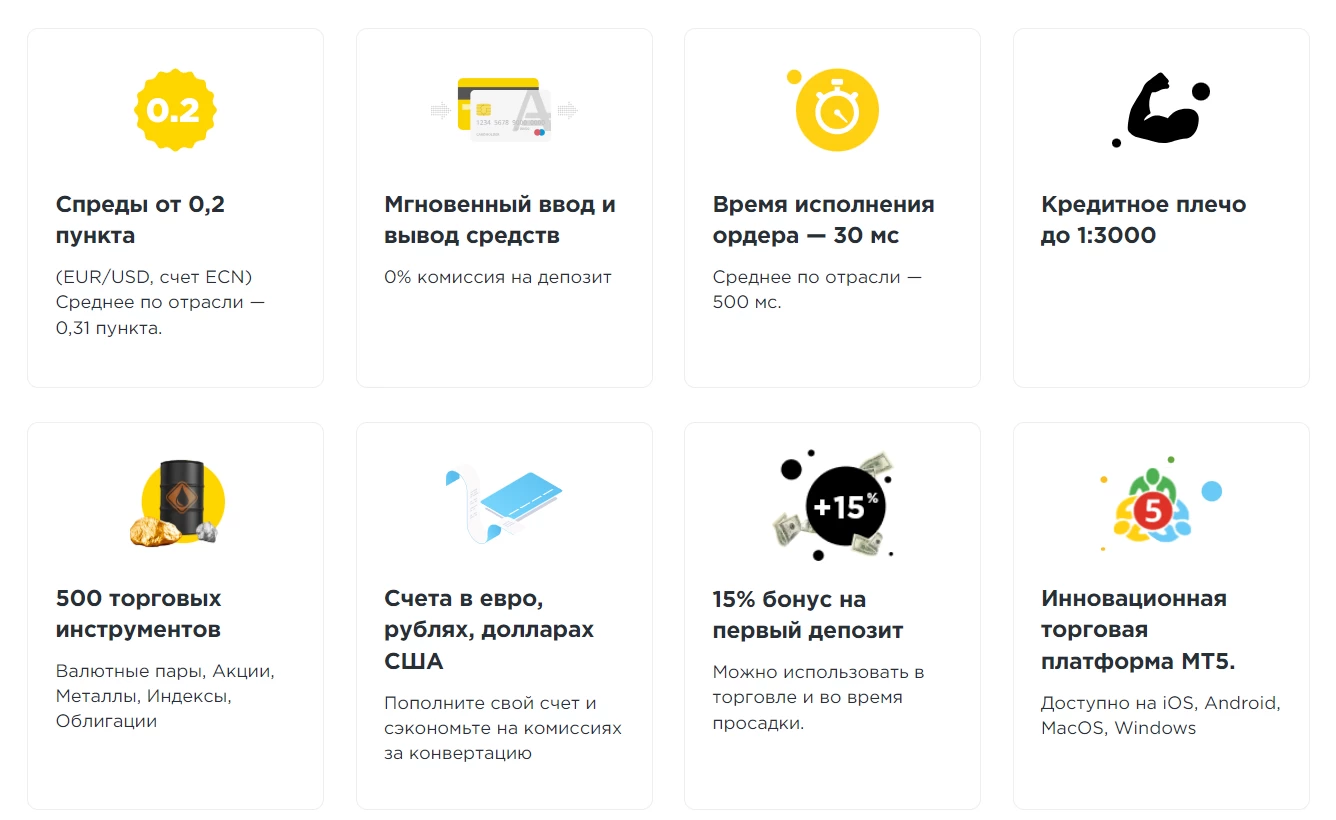

Trading conditions and feedback

Some of the most advantageous features of this intermediary are the ability to automatically insure players for 20 thousand euros, a 24-hour technical support line and an extensive trading range of about 500 assets (currency pairs, dividend-paying stocks, bonds, cryptocurrencies, metals, commodities, indices).

There are three tariff plans based on this broker: Fixed, Standard and ECN.

| Fixed | Standard | ECN | |

| Minimum deposit | 100 dollars/euro | 100 dollars/euro | 200 dollars/euro |

| Leverage | Up to 1:3000 | Up to 1:200 | |

| Transaction volume | From 0.01 lot in 0.01 increments | ||

| Spread | Fixed from 3 points | Floating from 1.3 points | Floating from 0 points |

| Commission |

– |

2.5 dollars/euro for 1 lot | |

| Stop Out level | 20% | 40% | |

| Account currency | USD, EUR | ||

In addition, the financial intermediary provides tools such as the Cayman indicator, news trading ideas, copy trading, uninterrupted services without electricity and the Internet, VPN for increased security, a free database of trading robots tested by analysts, a trade analyzer, Autochartist.

Depositing and withdrawing funds is possible in 15 different options, including plastic cards, bank transfers, cryptocurrencies and electronic payment systems. The maximum amount of cash you can receive per day is $1,000 or an equivalent amount in another currency. Applications are processed on weekdays from 8:00 to 17:00.

To contact a company representative, there are several ways: by phone number, email, Telegram and WhatsApp support bot.

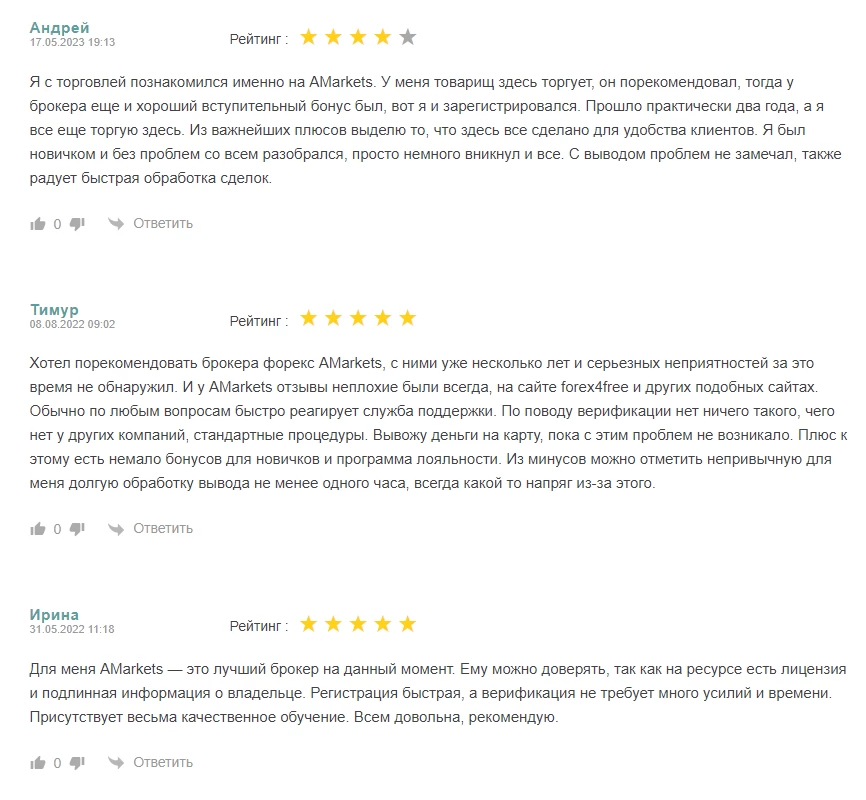

Reviews

Mostly clients speak positively about the broker. Sometimes there are shortcomings, but they are present everywhere in the market space. If the financial assistant subsequently corrects the problems that arose, there is no reason to blame him.

Results

Currently, more than a million users and 3 thousand partners cooperate with the company. Based on media reports and customer reviews, AMarkets is a reliable and honest broker for trading strategies and making good money.