Broker Interactive Investor says it has been helping countless investors take control of their financial future for over 25 years. The company claims to have many awards on its account, as well as the image of the largest investment platform in the UK. In this review, you will learn why the age of a financial assistant is not always an indicator of the quality of his work.

Broker legend

In the “About us” section on the company’s website, you can find out that Interactive Investor has been operating for more than two decades. At the same time, his website has existed only since September 2011, as Who Is claims:

Until July 2018, this domain had the prefix “beta”, and the site did not offer any financial services, which is confirmed by the web archive. The company has no 25 years of experience. But it is worth pointing out that staying on the financial market for 4 years is also a good result.

The principles of the company are reflected in the following qualities:

- openness in investment;

- friendliness with each client;

- fairness in fees;

- comprehensive customer support;

- ease of communication.

This is what Interactive Investor himself says. To what extent this information is true, the reviews of the broker’s ex-clients will later prompt.

What does the company offer?

The approach to investing at ii.co.uk involves choosing one of 3 types of accounts. Here are their main conditions:

- SIPP is a self-invested personal pension. The client invests £12.99 per month in promising assets, which are selected by the company’s expert;

- ISA is a general investment account. To avoid paying account maintenance fees, you need to make a monthly contribution of at least £25. It is possible to open SIPP for £9.99 in addition to this account;

- Junior ISA is an account for children of existing clients of the company. It implies a savings fund, which until the child reaches the age of majority is fully controlled by the parent.

Trading instruments are ETFs, trusts, stocks, currency pairs and funds. Interactive Investor offers to make transactions not only from a PC, but also thanks to a mobile application for iOS and Android.

Fees

On a separate page of the ii.co.uk website, you can get detailed information about broker commissions:

| Check | Type of fees | Fees/penalties |

| Investor, Pension Builder, Friends and Family member | Trading British and American Assets | £5.99 |

| super investor | Trading in other international assets | £5.99 |

| investor | free trade | £5.99 |

| Other monthly bills | Dividend Reinvestment | £0.99 |

Project reputation

On the net you can find a lot of comments regarding the work of Interactive Investor. Reviews about the broker are different, but the most important thing is that the negative becomes more and more every day. In some responses, they even call the project we are reviewing a scam and scammers. All this is a red flag for the client.

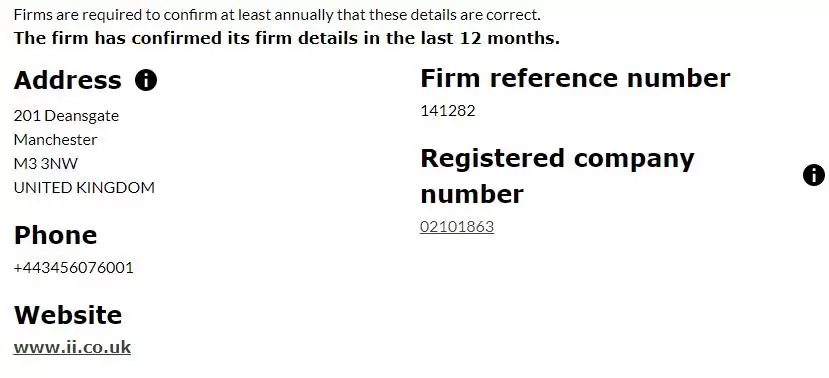

Main documents

The website of the British financial regulator confirms the information that Interactive Investor is a legal exchange intermediary. This means that in case of fraud on his part, you will be able to protect your rights in court, and with a high degree of probability you will receive monetary compensation.

But even the presence of a license does not protect the Interactive Investor client from the dishonesty of its employees. That is why the best solution for a trader would be to refuse to work with ii.co.uk in favor of a time-tested and experienced broker. Analyze your financial assistant very carefully!